25+ kentucky wage calculator

Web Kentucky state payroll taxes How do employers calculate withholding tax in Kentucky. Your average tax rate is 1167 and your marginal.

8 Salary Paycheck Calculator Doc Excel Pdf

While ZipRecruiter is seeing salaries as high as 154182 and as low as 41457 the majority of salaries within the Calculator.

. Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. This makes calculating withholding.

More stats are available in the. Web The second algorithm of this hourly wage calculator uses the following equations. The Kentucky minimum wage is 725 per hour.

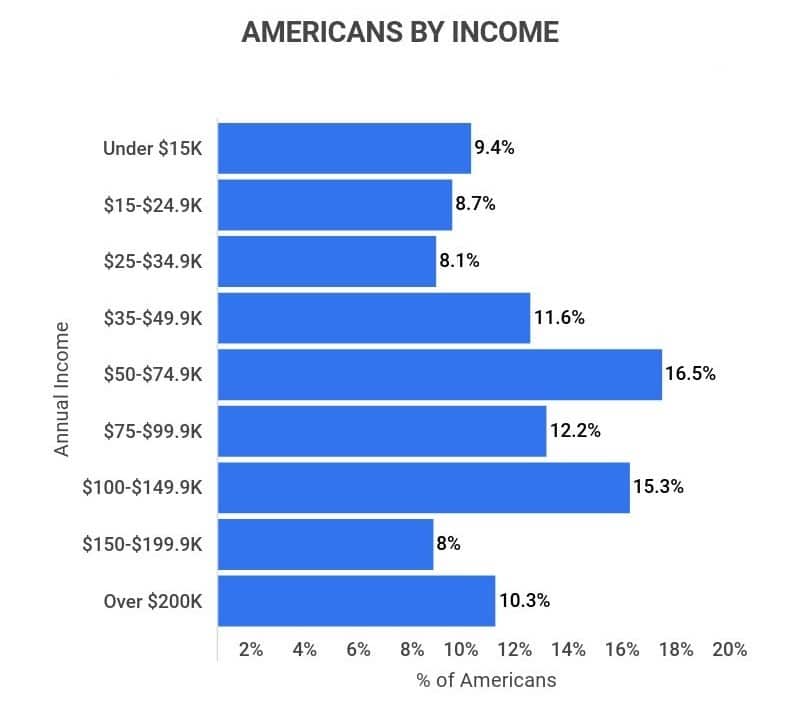

Web Kentucky Income Tax Calculator 2022-2023 If you make 70000 a year living in Kentucky you will be taxed 11493. Web In the US in 2022 the median individual income average individual income and top 1 individual income were 46001 66755 and 401622. Web 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

Web How much does a Calculator make in Kentucky. Web The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of. Web Deduct and match any FICA taxes.

Web The current minimum wage in Kentucky is equal to the federal minimum wage of 725. In Kentucky tipped employees such as waitresses bartenders and busboys also have to factor their earned tips into their total wages as. Amount Equivalent to 30x the Federal Minimum Wage of 725 based on your pay frequency Weekly or less 21750 Every other week 43500 2x per.

Web Living Wage Calculation for Kentucky. The Cash Minimum Wage rate for a Tipped employee who earns more than 30 a. The Kentucky Minimum Wage is the lowermost hourly rate that any employee in Kentucky can expect by law.

Web Kentucky Tipped Wage Calculator. Kentucky uses a flat 5 tax rate on personal income. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

- A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C. Web Use our calculator to discover the Kentucky Minimum Wage. Calculate the FUTA Unemployment Taxtax credit of up to 54 which brings your.

Web Kentucky Salary Paycheck Calculator. Web tool Kentucky paycheck calculator Payroll Tax Salary Paycheck Calculator Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or.

25 Essential Average American Income Statistics 2023 Household Personal Income In The Us Zippia

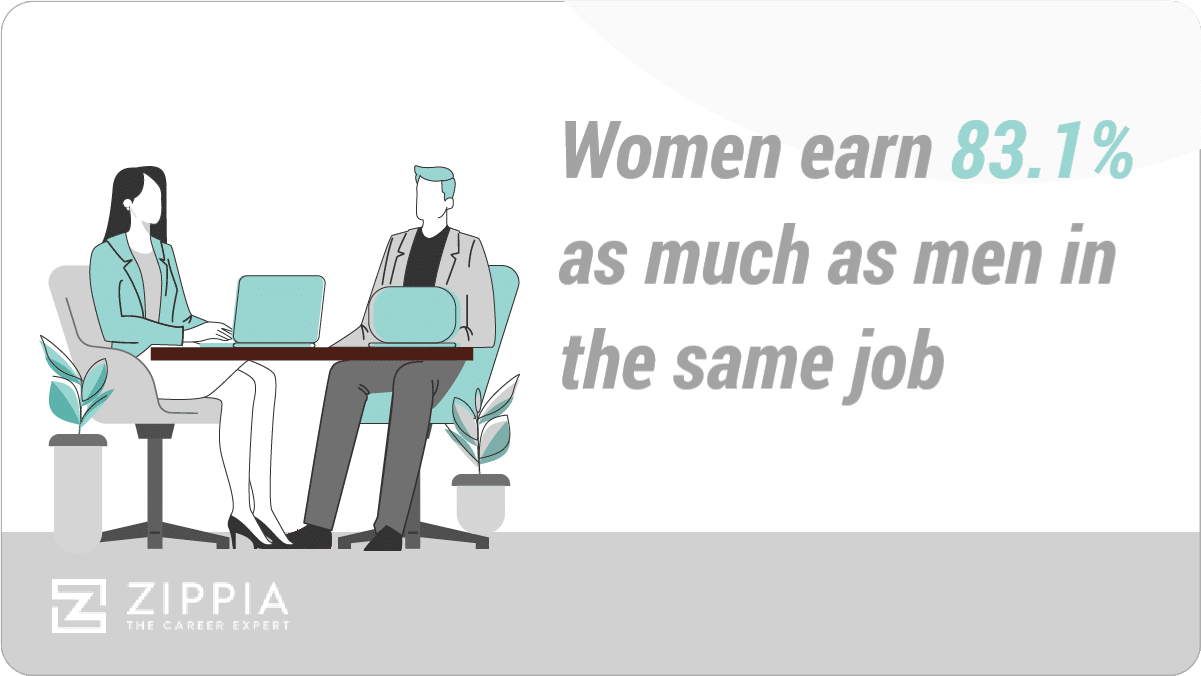

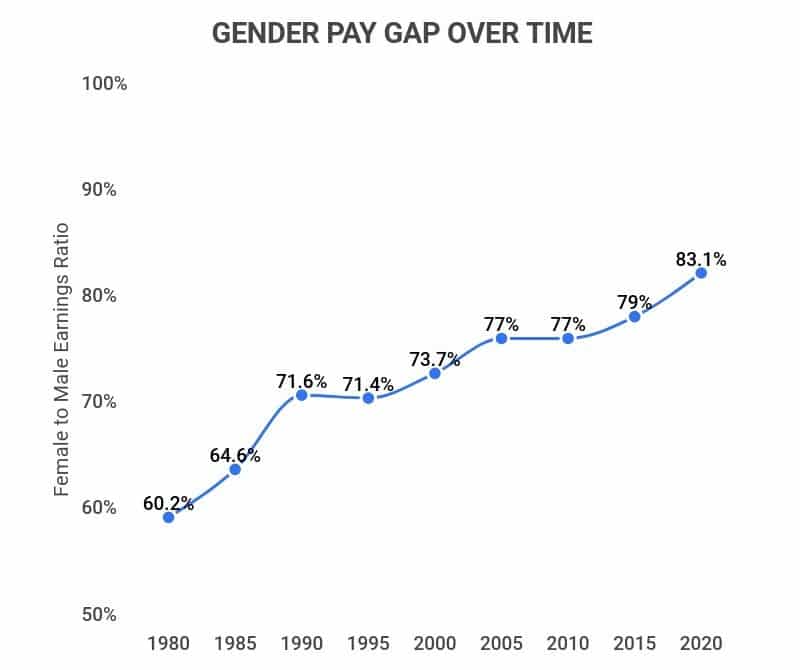

25 Troubling Gender Pay Gap Statistics 2023 Does The U S Have Equal Pay Zippia

Kentucky Paycheck Calculator Tax Year 2022

Kentucky Income Tax Calculator Smartasset

Nzd Definition Financial Dictionary Fxmag Com

Kentucky Paycheck Calculator 2022 2023

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

The Salary Calculator Hourly Wage Tax Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

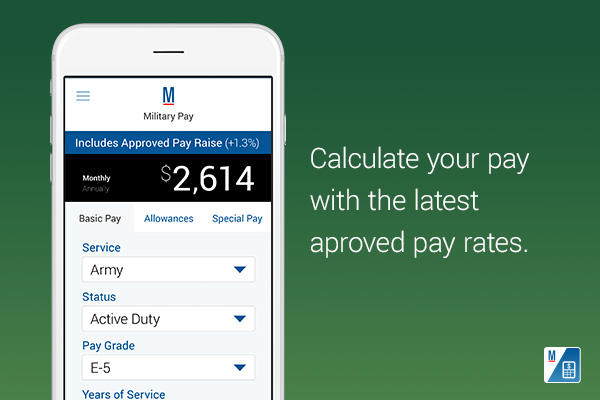

Military Pay App Mobile Pay App Military Com

How To Calculate Your Annual Salary Easy Formulas

25 Troubling Gender Pay Gap Statistics 2023 Does The U S Have Equal Pay Zippia

Cow Country News March 2018 By The Kentucky Cattlemen S Association Issuu

Kentucky Paycheck Calculator Tax Year 2022

Certain Information Has Been Removed Or Redacted From The Text To

Kentucky Hourly Paycheck Calculator Gusto

Top 5 Best Salary Calculators 2017 Ranking Top Net Gross Salary Calculators Advisoryhq